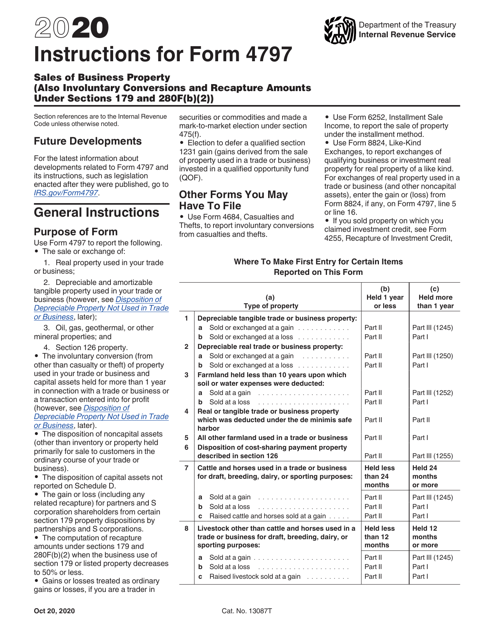

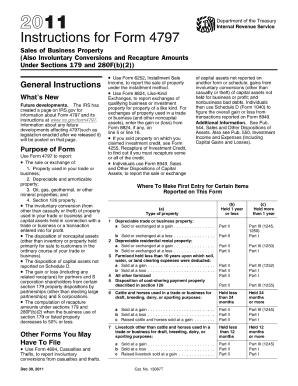

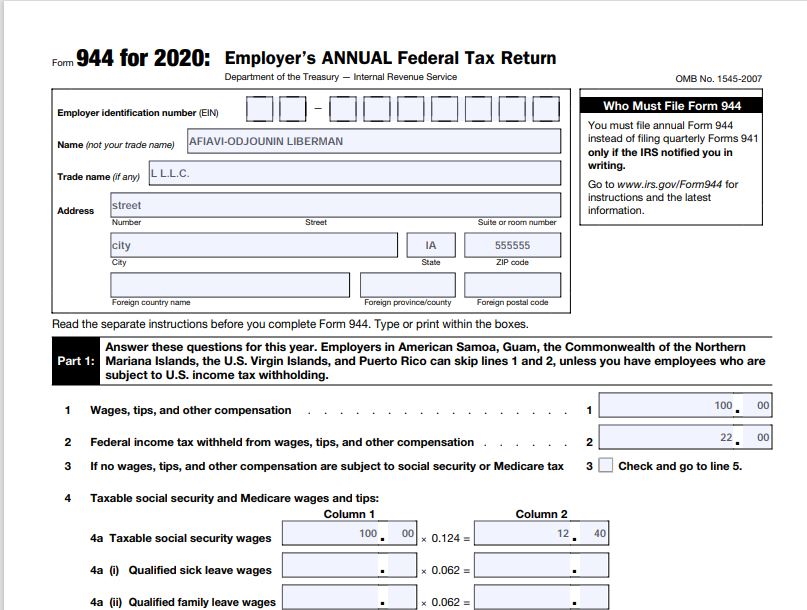

Developments related to Form 4797 and its instructions, such as legislation enacted after they were published, go to IRSgov/Form4797 General Instructions Purpose of Form Use Form 4797 to report • The sale or exchange of 1 Real property used in your trade or business;IRS Instructions for Form 4797 Taxpayers who sell or transfer business property during the tax year generally must complete IRS form 4797, Sale Instructions for Form 4797 (15) IRS govThe way to complete the IRS Instruction 4797 online Click the button Get Form to open it and start modifying Fill in all needed lines in the selected file utilizing our advantageous PDF editor Turn the Wizard Tool on to complete the process much easier

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Irs form 4797 instructions

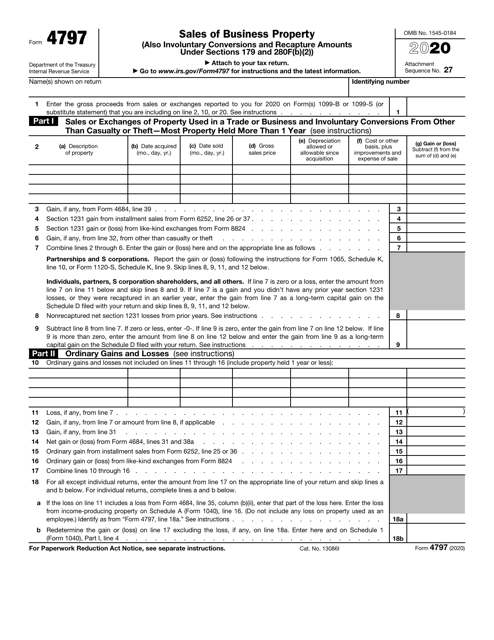

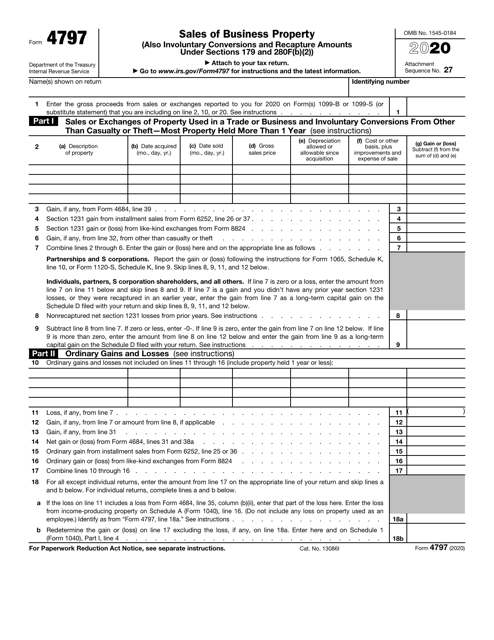

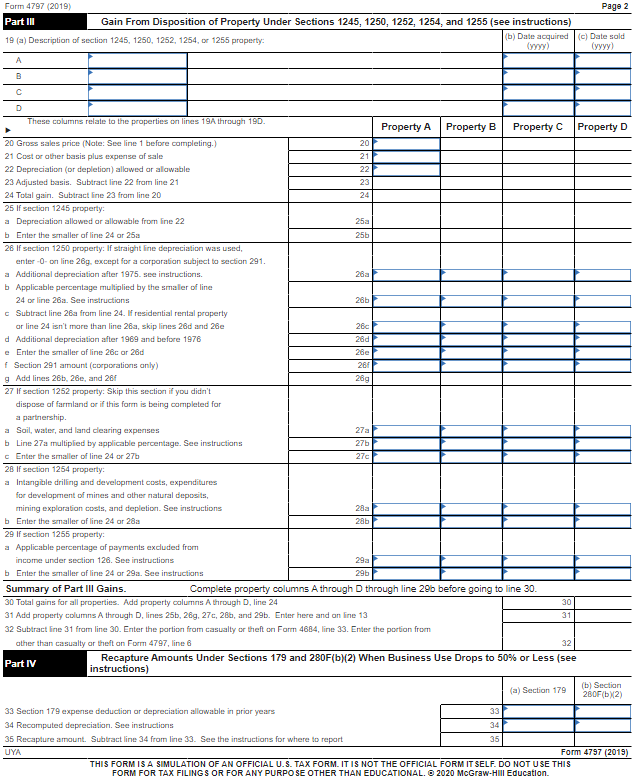

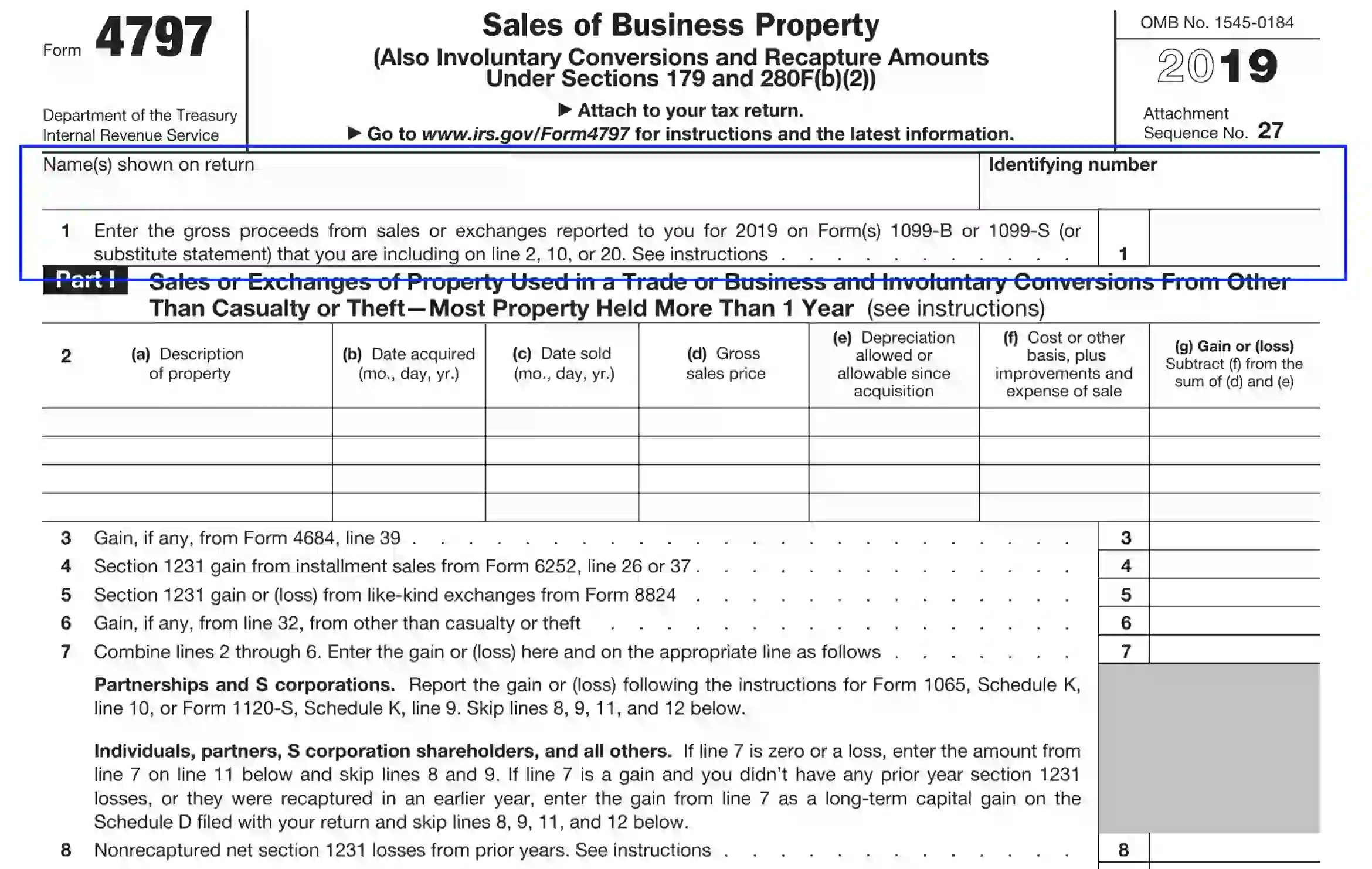

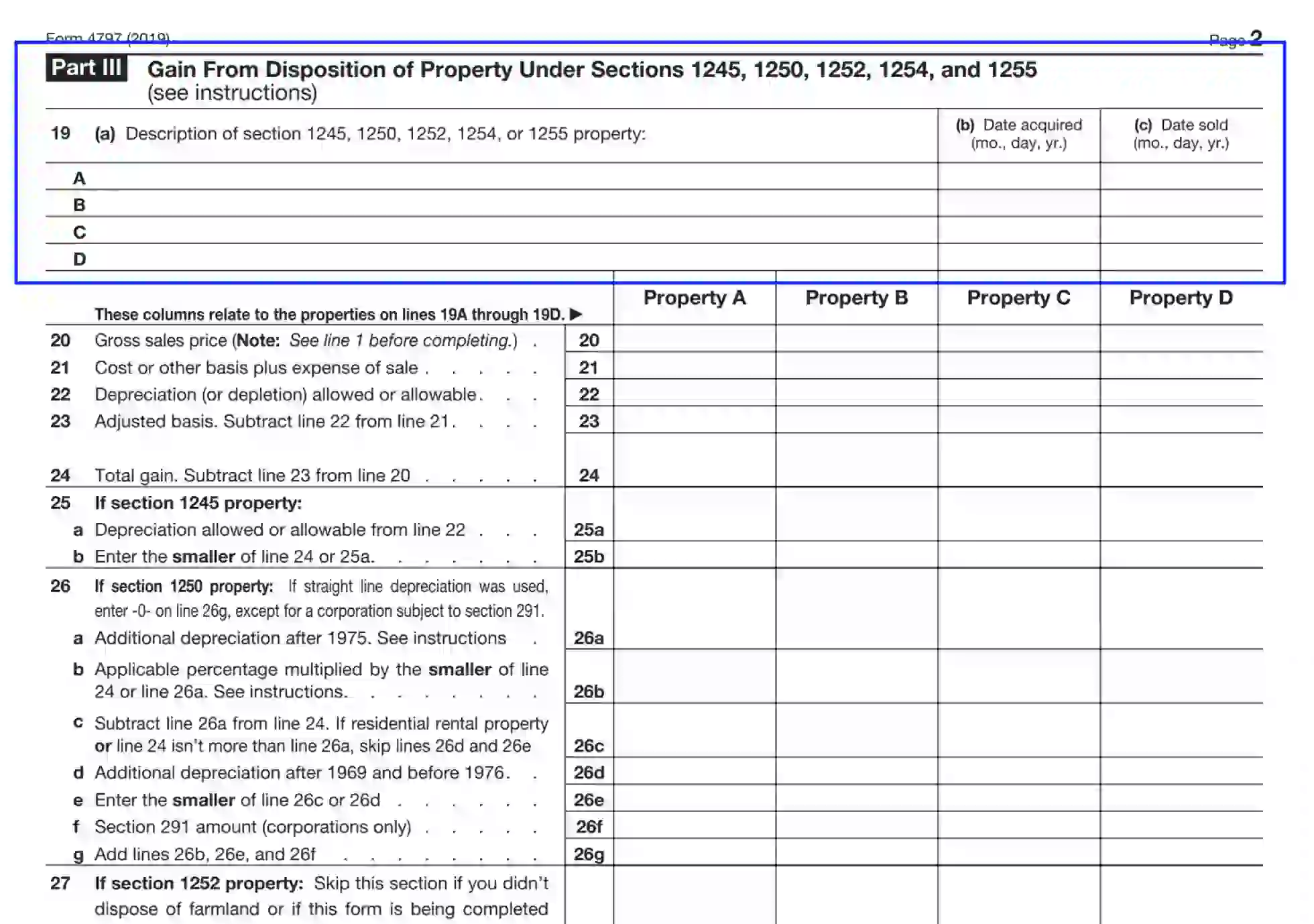

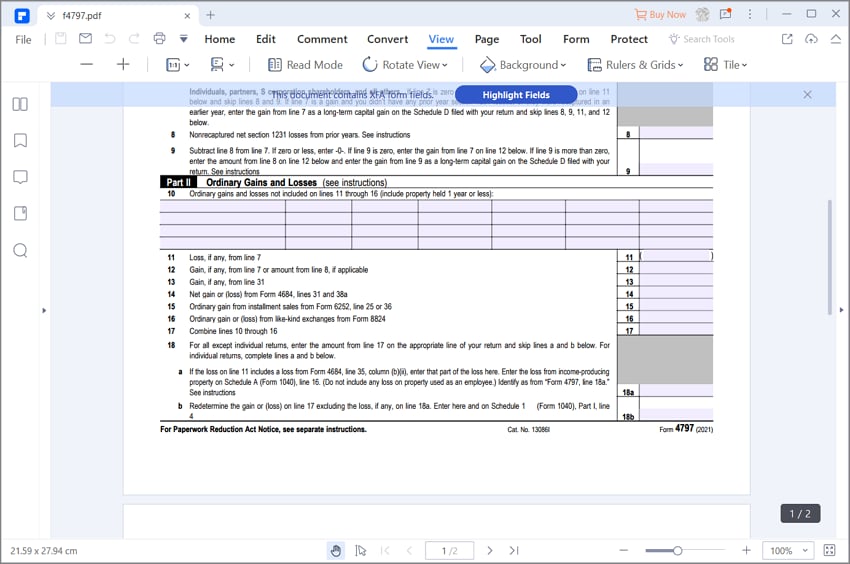

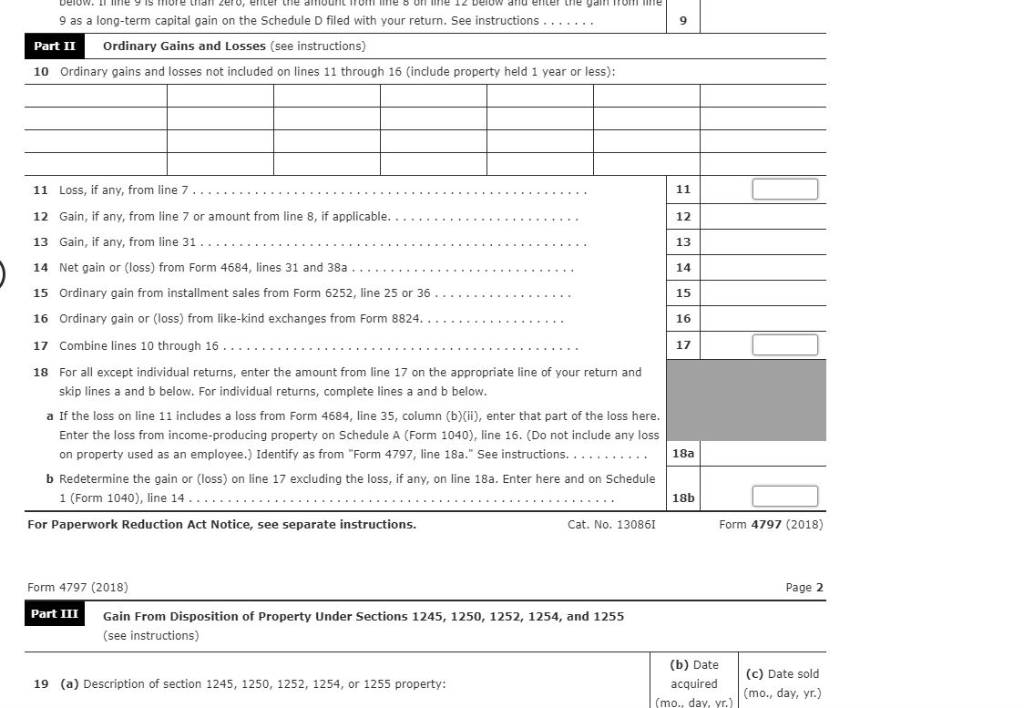

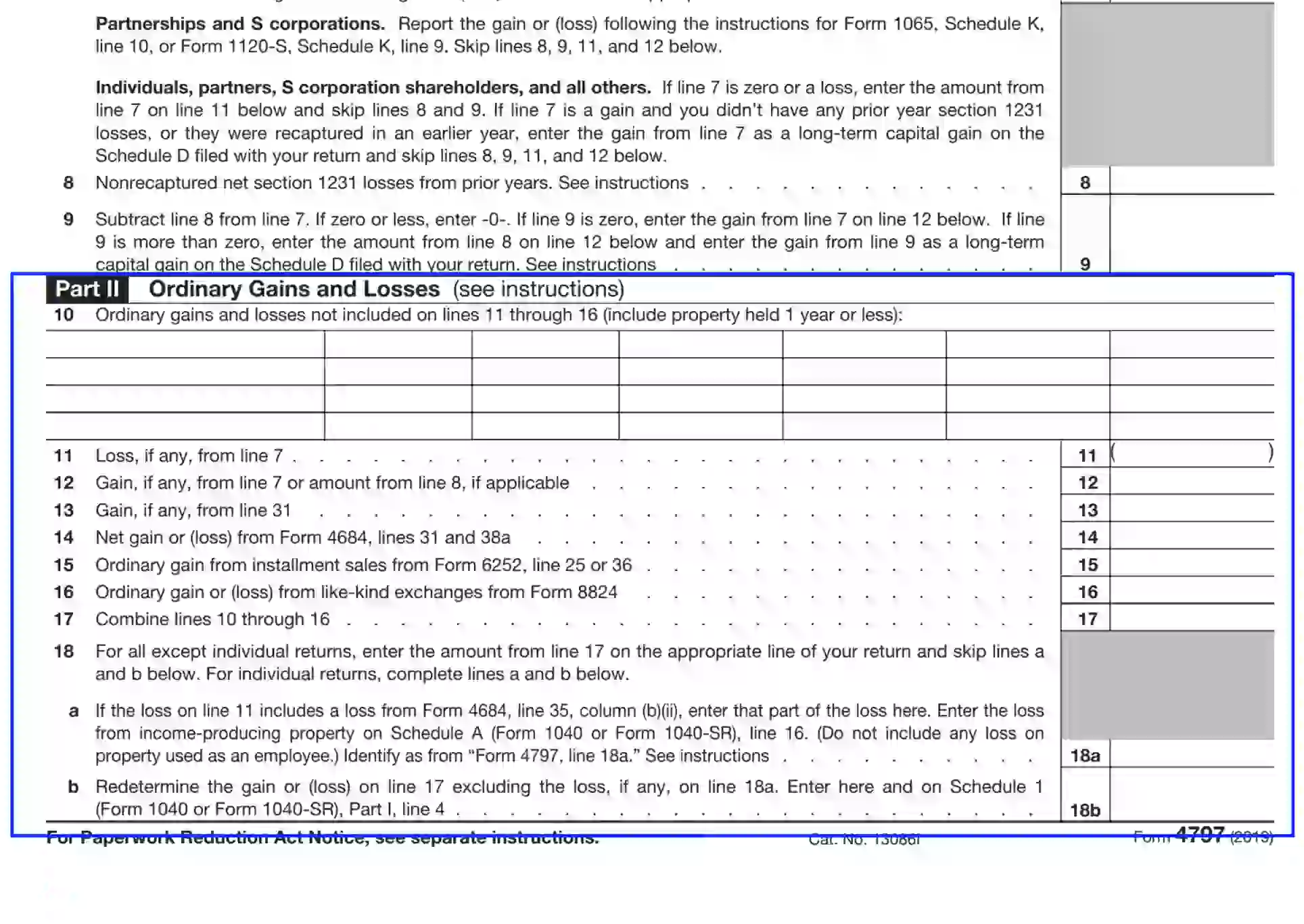

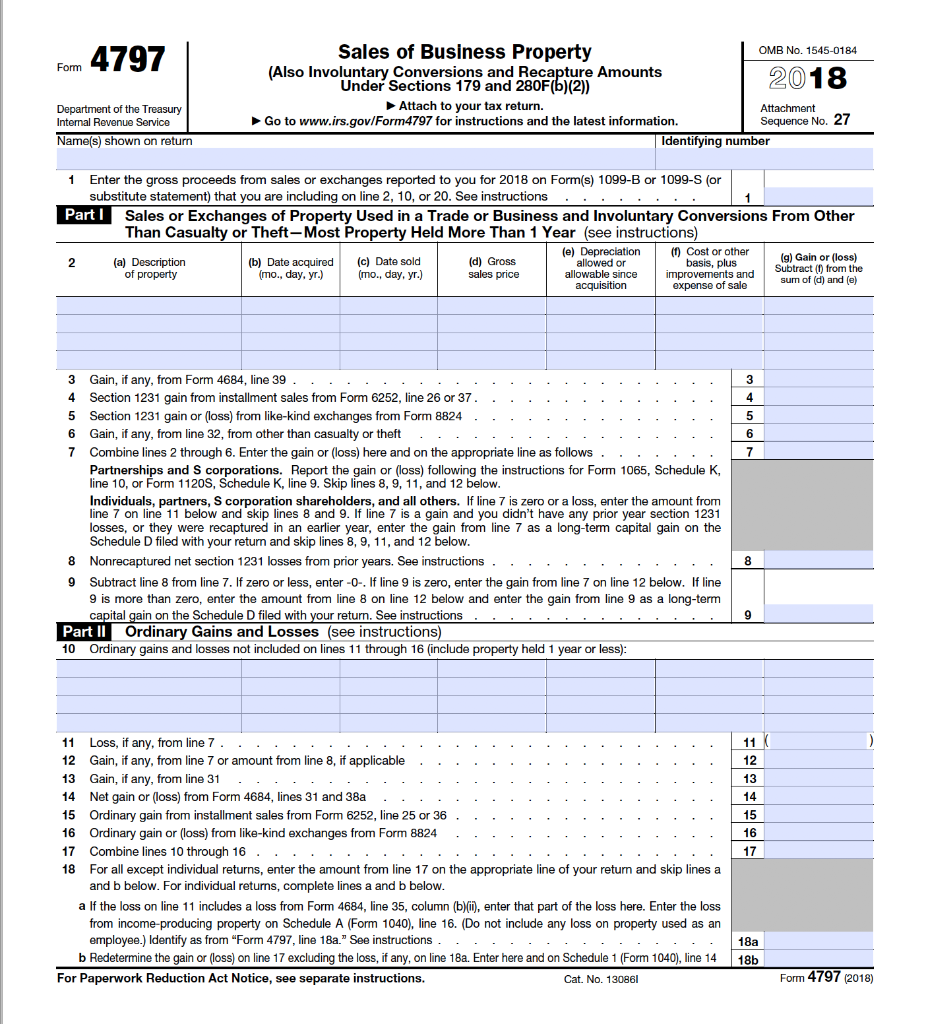

Irs form 4797 instructions-29/6/18 · IRS form 4797 is comprised of three parts Depending on the type of asset you're claiming, you'll need to account for the asset in either part I, part II, or part III When you look at each part of the form, though, you're directed to the IRS form 4797 instructions to determine what type of property belongs in that sectionFillable Printable Form 4797 What is a Form 4797 ?

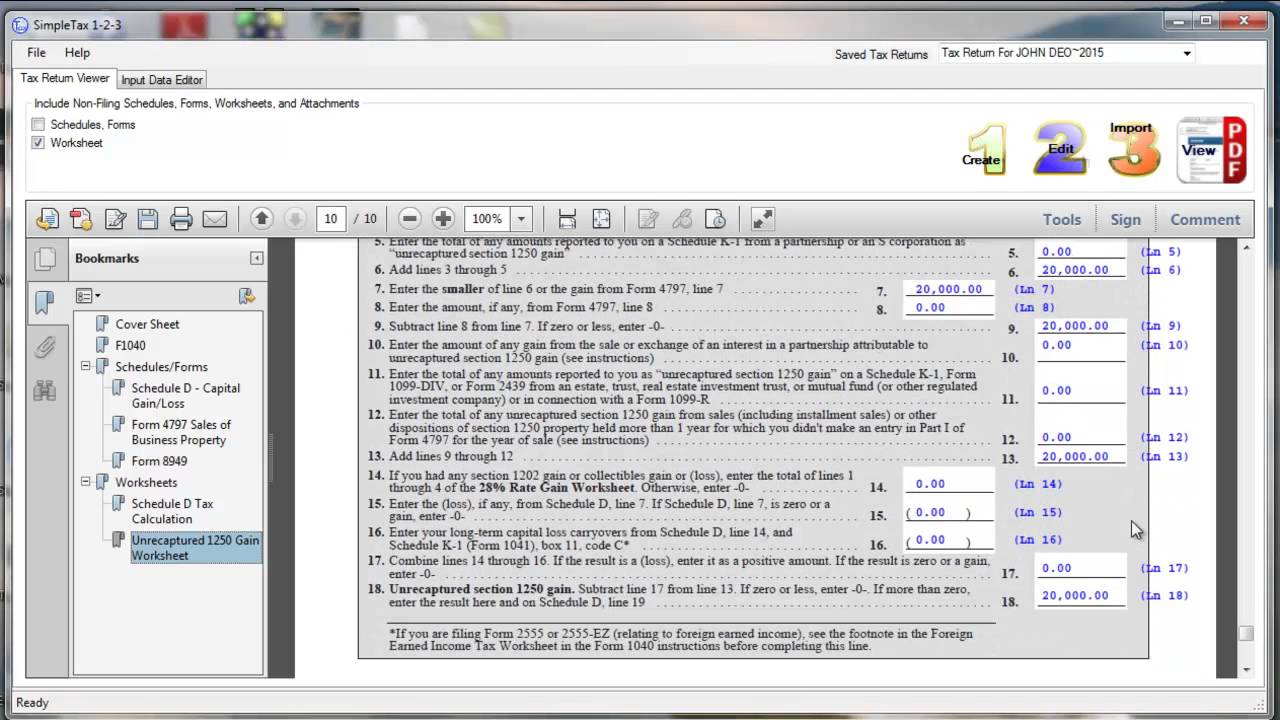

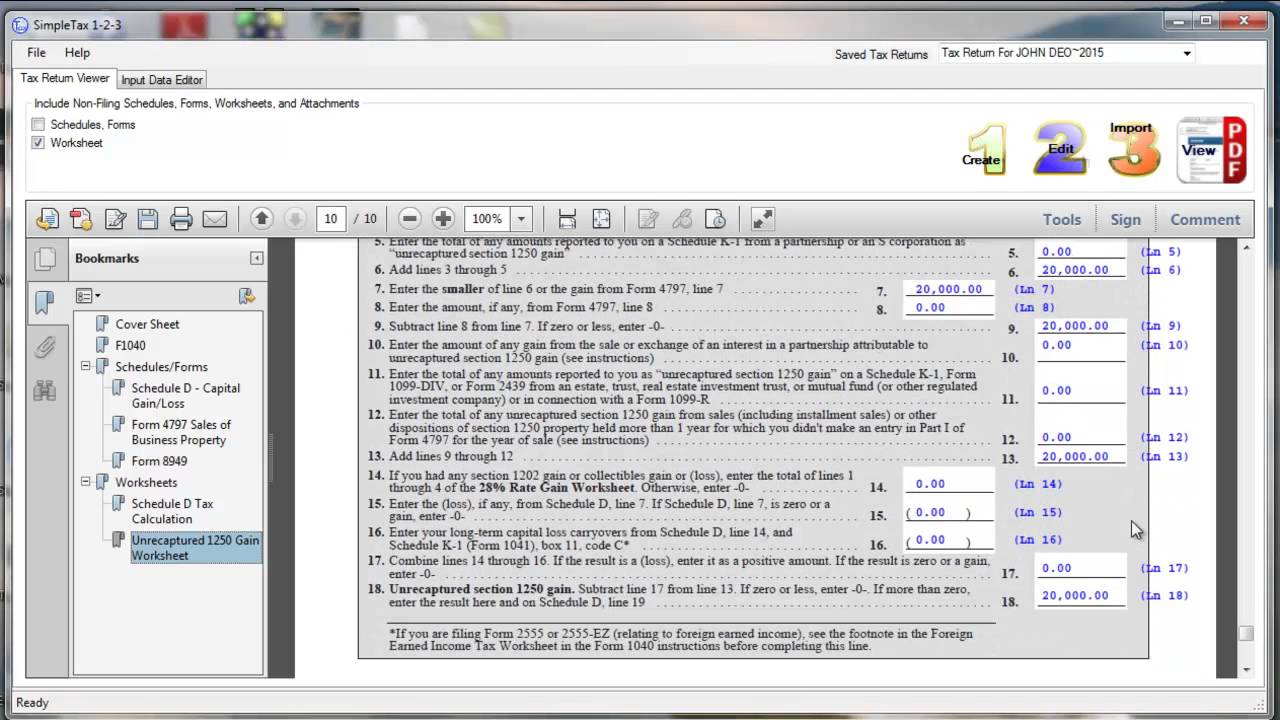

Simpletax Form 4797 Youtube

Instructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingInformation, put and ask for legallybinding digital signatures Get the job done from any gadget and share docs by email or fax2 Depreciable and amortizable tangible property used in your trade or

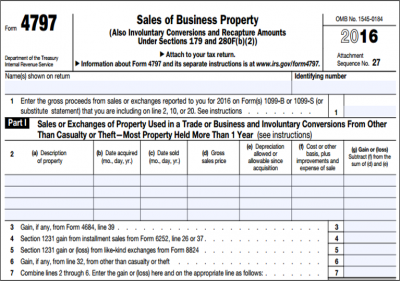

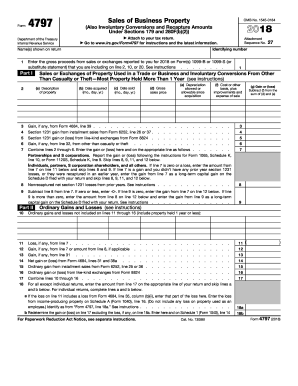

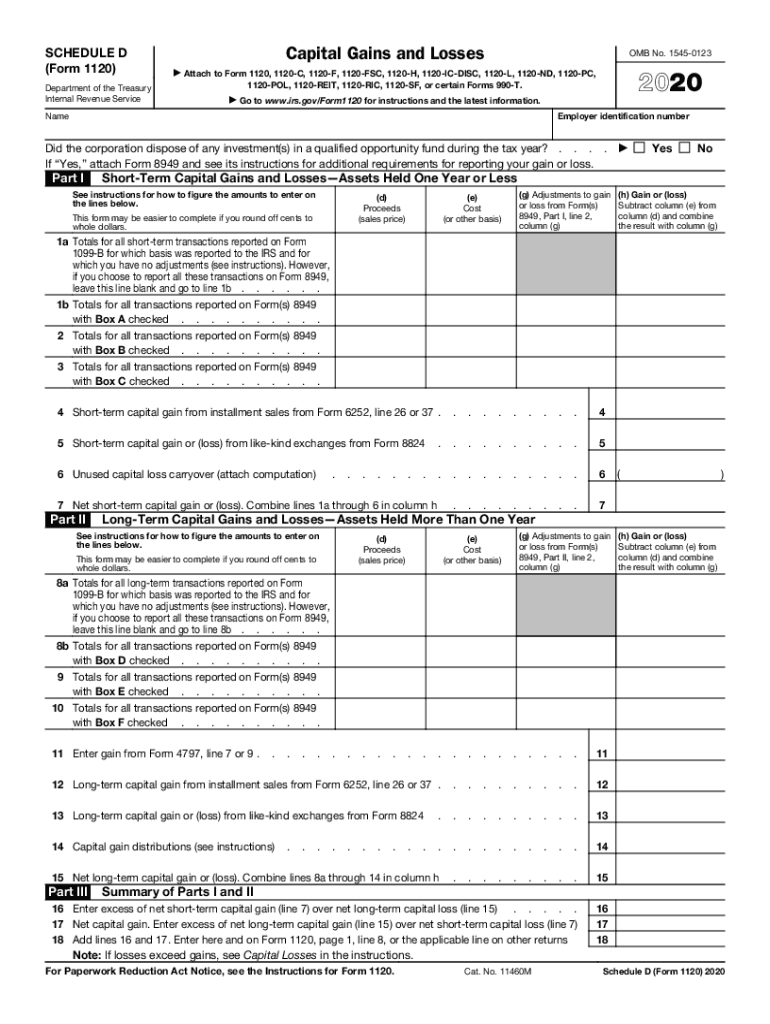

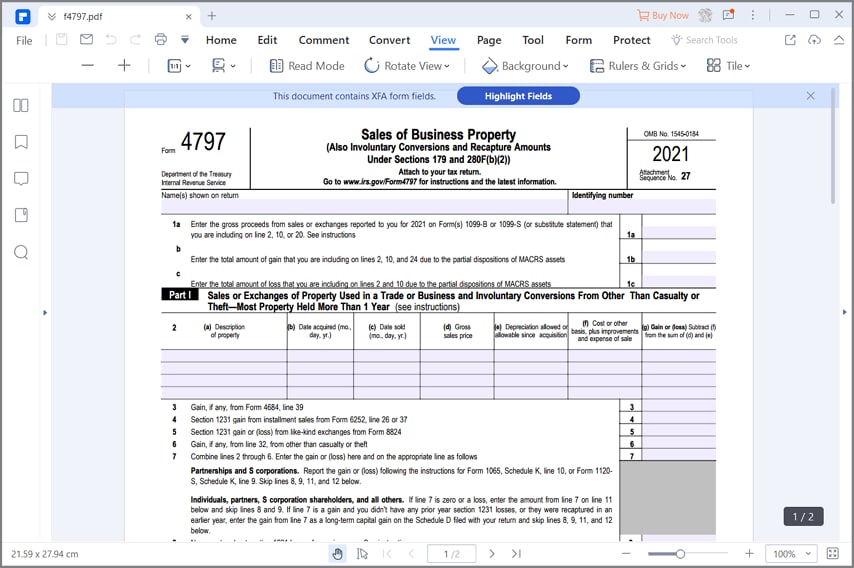

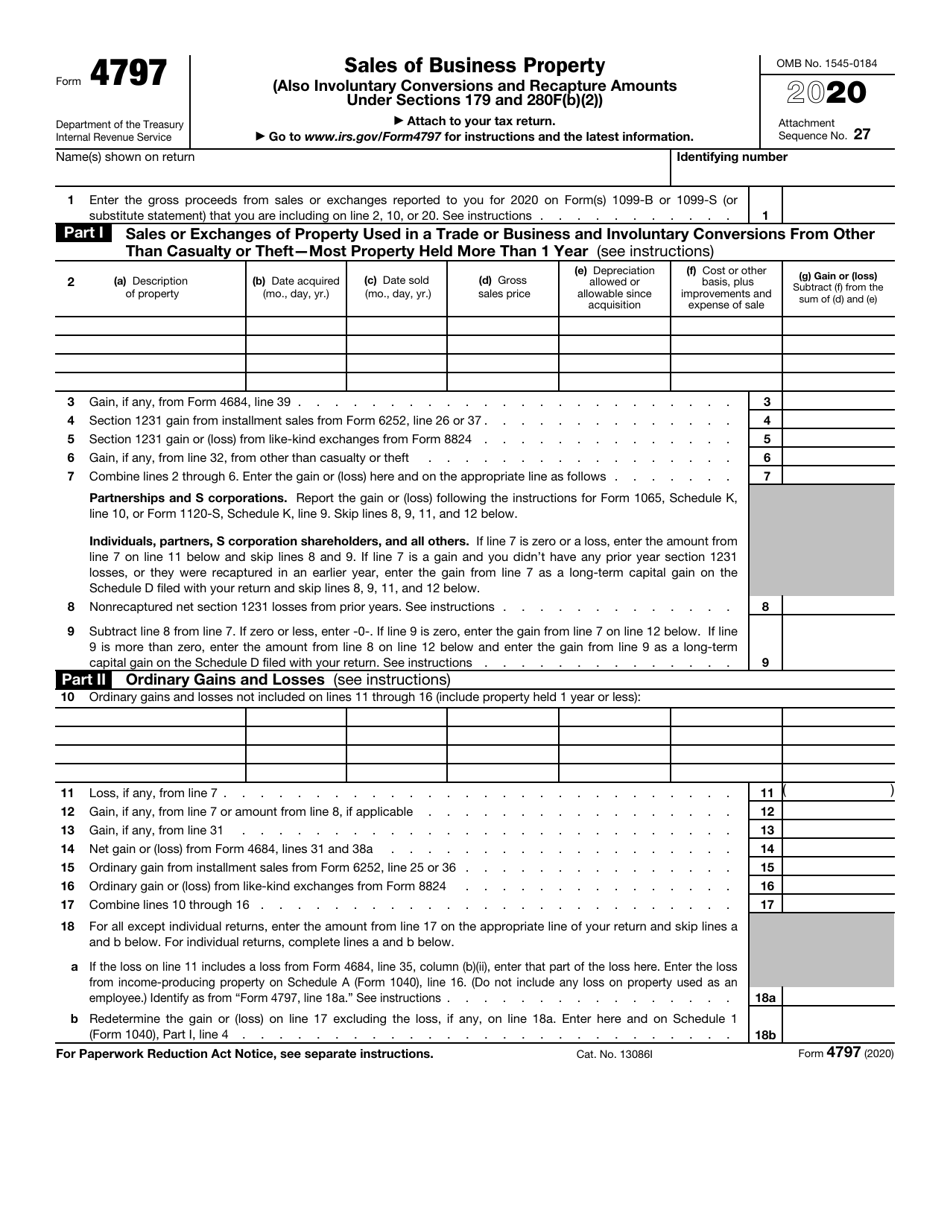

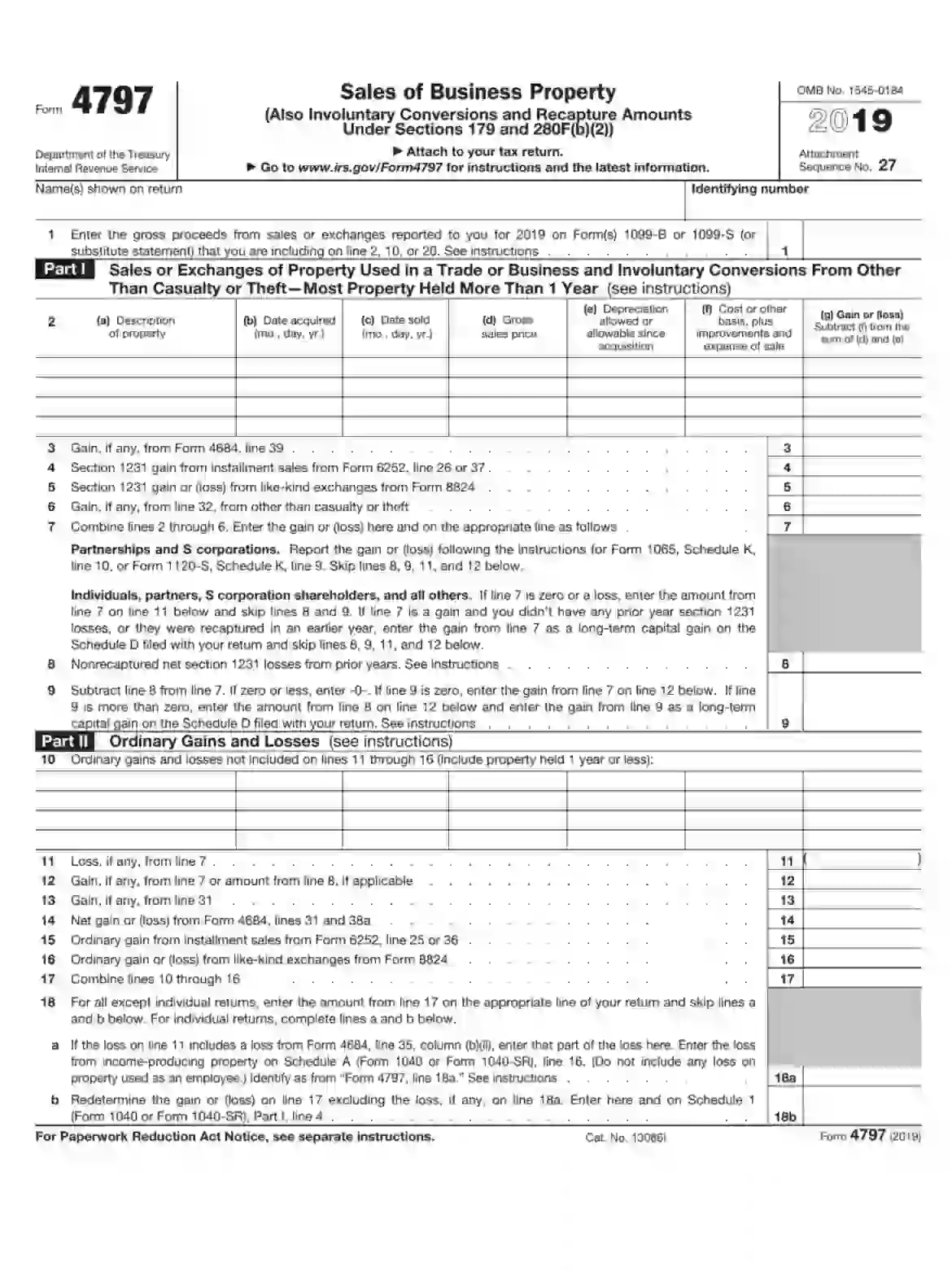

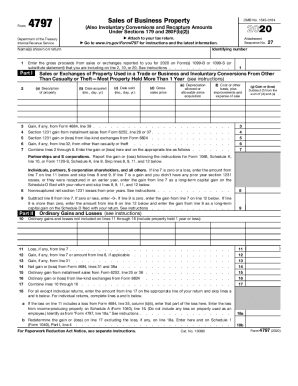

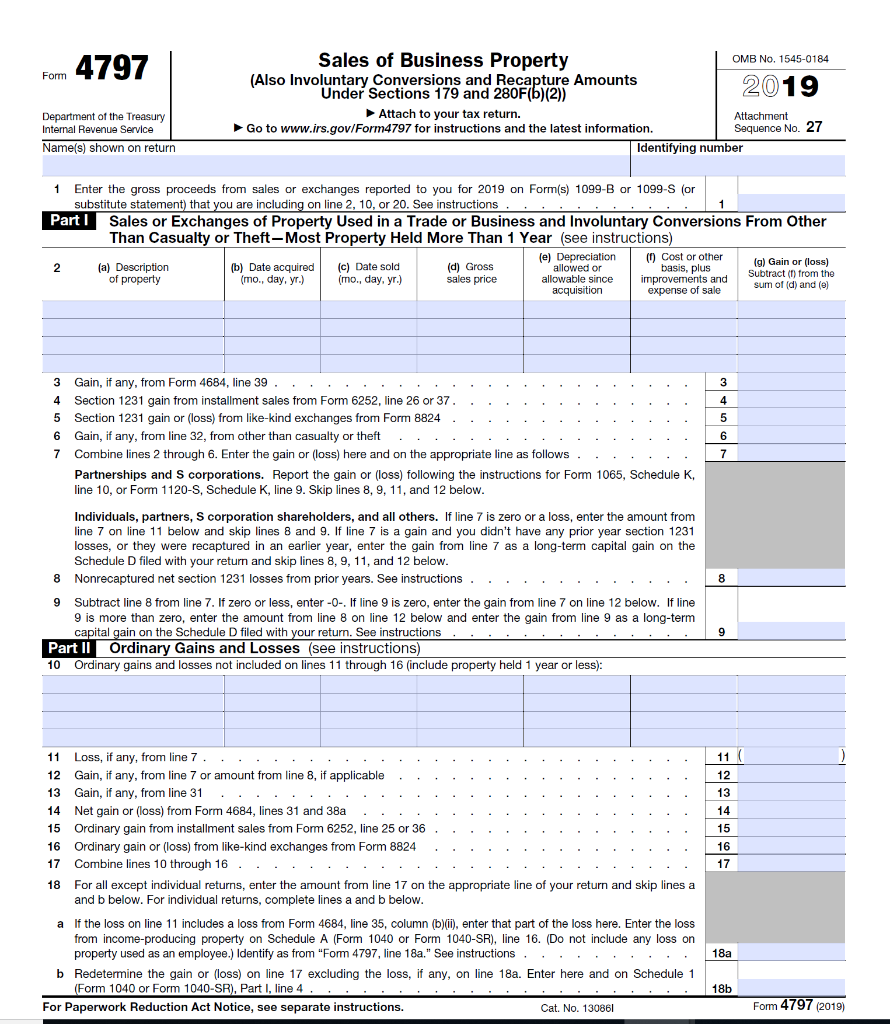

Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No 19 Attachment Sequence No 27 Name(s) shown on returnInstructions for Form 4768, Application for Extension of Time To File a Return and/or Pay US Estate (and GenerationSkipping Transfer) Taxes 02 Inst 4797 Instructions for Form 4797, Sales of Business Property Inst 5227This is an example of using Form 4797 for sales of rental property

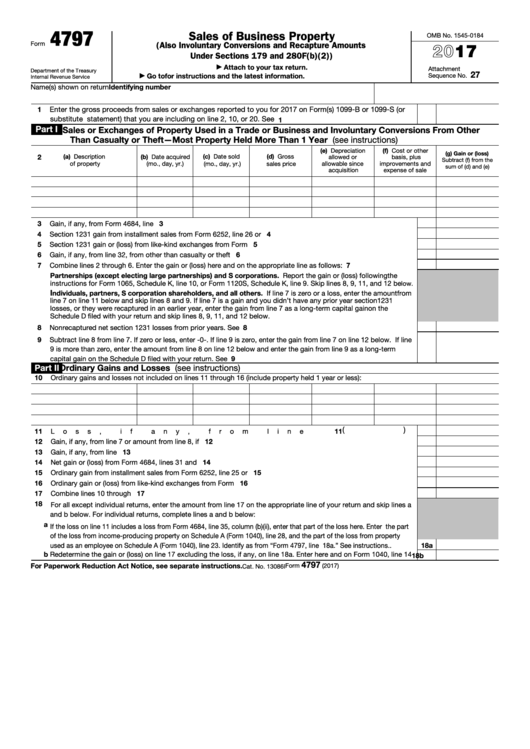

Instructions for Form 4797, Sales of Business Property 18 Form 4797 Sales of Business Property 17 Inst 4797 Instructions for Form 4797, Sales of Business Property 17 Form 4797 Sales of Business Property 16 Inst 4797 Instructions for Form 47978/2/18 · Form 4797 Example Fill out, securely sign, print or email your irs form 4797 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No Attachment Sequence No 27 Name(s) shown on return

What Is Form 1065 Get Form Filing Instructions For

Blank Irs Federal Tax Form Schedule 3 For Reporting Additional Credits And Payments Stock Photo Alamy

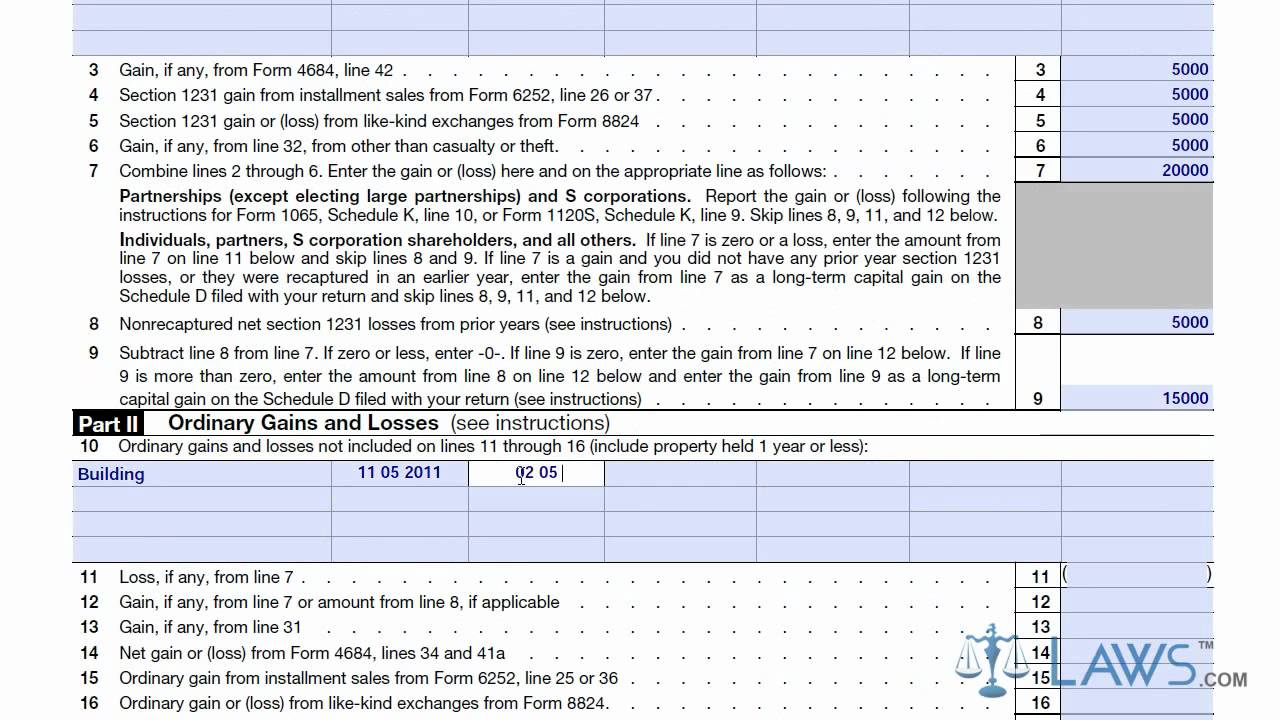

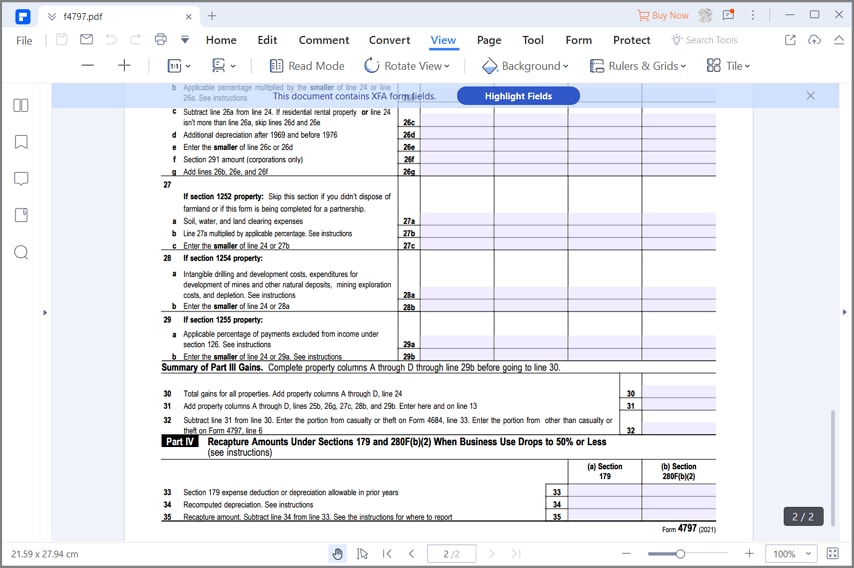

6/4/21 · Form 4797 is made up of four separate parts Which part of Form 4979 you'll use depends on the kind of property and your gain or loss If the property was held for more than a year, Part 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft needs to be usedInst 4797 Instructions for Form 4797, Sales of Business Property Form 45 Farm Rental Income and Expenses 01/25/21 Form 4868 Application for Automatic Extension of Time to File US Individual Income Tax Return Form 4868 (SP)Get And Sign Irs Instructions Form 4797 1021 Capital gains invested in Qualified Opportunity Funds If you have a capital gain in 18, you can invest that gain into a Qualified Opportunity Fund and elect to defer part or all of the gain that you would otherwise include in income until December 31, 26

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Individual Tax Return Problem 5 Form 4797 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 Course Hero

Filling Out Irs Form 4797 Step By Step Fill out, securely sign, print or email your Form 4797 Internal Revenue Service irs instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsForm 4797 instructions Take full advantage of a electronic solution to create, edit and sign contracts in PDF or Word format on the web Transform them into templates for numerous use, add fillable fields to collect recipients?

Opportunity Zones Tax Returns How To

Form Irs Instruction 4797 Fill Online Printable Fillable Blank Pdffiller

2 Depreciable and amortizable tangible property used in your trade or business (however, see Disposition of Depreciable Property Not Used in Trade or Business, later);According to the IRS Instructions for Form 4797, you should file this Form with your return if you sold orForm 4797, also known as sales of business property, is an internal revenue serviceissued tax form and used to report gains made from the sale or exchange of business property business property may refer to property purchased in order to produce rental income or a home that was used as a business

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Form 4797 Take full advantage of a electronic solution to generate, edit and sign contracts in PDF or Word format online Convert them into templates for multiple use, include fillable fields to gather recipients?IRS Instructions for Form 4797 Taxpayers who sell or transfer business property during the tax year generally must complete IRS form 4797, Sale of Business Use the worksheet, later, to figure the amount to report on Form 4797, 4684, 6252, or 84, and to figure any reduction in your carryforward of the unused Sales or exchanges of real or depreciable property used in a trade orForm 4797 And Instructions IRS Form 4797 instructions discussed by rental real estate property CPA / Form 1099C instructions / Form 1099A instructions / Form 85 instructions Per IRS form 4797 instruction and Pub 17, example2 on page 114, if you sold property that was your home and you used it to produce rental income, you may

Eeqdyzyr9nku M

What Is Irs Tax Form 6252

30/7/ · Form 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes This can include but is not limited to any property that was used to generate rental income or aForm 4797, write "Section 121 exclusion," and enter the amount of the exclusion as a (loss) in column (g) If the property was held for 1 year or less, report the sale and the amount of the exclusion, if any, in a similar manner on line 10 of Form 4797 Involuntary Conversion of Property You may not have to pay tax on a gainData, put and ask for legallybinding electronic signatures Work from any gadget and share docs by email or fax Check out now!

What You Need To Know About Form 4797 Millionacres

Required Information The Following Information Ap Chegg Com

On Form 4797, line 2, enter "Section 1397B Rollover" in column (a) and enter as a (loss) in column (g) the amount of gain included on Form 4797 that you are electing to postpone If you are reporting the sale directly on Form 4797, line 2, use the line directly below the line on which you reported the sale15/8/ · Use Form 4797 to report Information about Form 4797, Sales of Business Property, including recent updates, related forms and instructions on how to file Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assetsThat may affect Form 4797) and make it available for 17, go to IRSgov/ Extenders General Instructions Purpose of Form Use Form 4797 to report The sale or exchange of 1 Real property used in your trade or business;

Fillable Form 4797 Sales Of Business Property 17 Printable Pdf Download

Basic Schedule D Instructions H R Block

Instructions for Form 4506A, Request for Public Inspection or Copy of Exempt or Political Organization IRS Form 0121 01/21/21 Form 4506C IVES Request for Transcript of Tax Return 09 Form 4506F Request for Copy of Fraudulent Tax Return 0319 04/24/19 Form24/2/21 · As with other IRS forms, the form 4797 comes with detailed instructions It is advisable to read the instructions fully before starting on the form, as answers to many common questions can often be found further down in the instructionsGet And Sign Irs Form 4797 1721 Part I 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 (c) Date sold (mo, day, yr) (b) Date acquired (mo, day, yr) (e) Depreciation allowed or allowable since acquisition (d) Gross

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Examples Of Tax Documents Office Of Financial Aid University Of Colorado Boulder

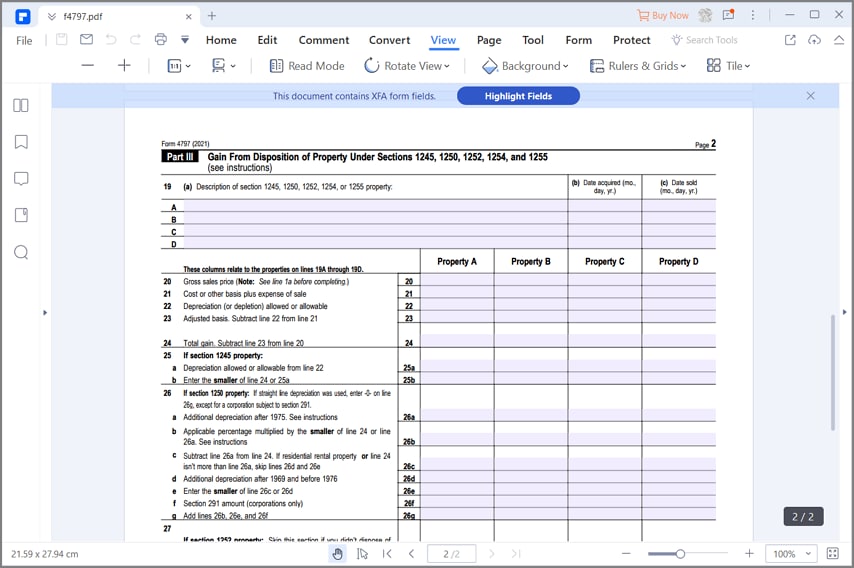

5/4/19 · Federal Form 4797 Instructions For the latest information about developments related to Form 4797 and its instructions, such as legislation enacted after they were published, Also use Form 6252 to report any payment received during your 14 tax year from a sale made in an earlier year that you reported on the installment methodRecaptured as ordinary income on Form 4797 Use Part III of Form 4797 to figure the amount of ordinary income recapture The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III If the total gain for the depreciable property is more than the recapture amount, the excess isIrs Form 4797 Instructions 1521 Acquired from de cedent An estate (or other person) required to file an estate tax return after July 31, 15, must provide a statement to both the IRS and any beneficiary who receives property from the estate The statement must show the estate tax value of the property

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

Irs Form 4797 Fill Out Printable Pdf Forms Online

This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information as a courtesy Do not file draft forms Also, do not rely on draft forms, instructions, and publications for filing We generally do not release drafts of forms until we believe we have incorporated all changesInstructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Form 4797 Sales of Business Property « PreviousGenerally, Form 4797 is used to report the sale of a business This may include your home that was converted into a rental property or any real property used for trade or business Who Can File Form 4797 Sales of Business Property?

Reporting Gambling Winnings Other Income On Schedule 1 Don T Mess With Taxes

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

2 Depreciable and amortizable tangible property used in your trade or business (however, see Disposition ofThis document contains official instructions for IRS Form 4797, Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f (B) (2)) a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the US Department of the TreasuryThe qualified gain is, generally, any gain recognized in a trade or business that you would otherwise include on Form 4797, Part I This exclusion also applies to an interest in, or property of, certain renewal community businesses

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

Irs Schedule D Form 49 Guide For Active Traders

Instructions for Form 4797, Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderGet And Sign 4797 Instructions Irs Form Form Use Form 4797 to report • The sale or exchange of 1 Real property used in your trade or business;30/1/16 · Forms and Instructions (PDF)Forms and Instructions (PDF) Show per page « Previous Product Number Title Revision Date Posted Date Form 1 09 8 Q Qu

Irs Form 4797 Fill Out Printable Pdf Forms Online

Internal Revenue Service Irs Form 1040 Us Individual Income Editorial Stock Image Image Of 15th Service

Form 4797 instructions Fill out forms electronically utilizing PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve forms using a legal digital signature and share them through email, fax or print them out Save files on your PC or mobile device Improve your efficiency with effective service!Form 4797 is intended for use as a means of reporting a business property sale Any individual who sold a business property or traded the business property during that tax year must complete this form The definition of property for the purposes of this form isn't limited to inhabitable land but also can include oil or mineral properties12/5/21 · Use PDF form filler like PDFelement that enables to add, edit, delete texts easily It will enable you to be efficient and simplifies your work Read through the IRS form 49 instructions so that you can fill the form accurately and avoid penalties You must fill Form 49 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

7/1/21 · Instructions for How to Complete IRS Form 4797 Filling the IRS form 4797 is easy and can be done very fast using the PDFelement However, the following steps given below will guide you to complete this form Step 1 First of all, you can get this form from the department of treasury or you can just download it from their official website/8/12 · Visithttp//legalformslawscom/tax/form4797To download the Form 4797 in printable format and to know aboutthe use of this form, who can use this Form 479

Form 4797 Sales Of Business Property

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Manufactures And Distributes High Tech Biking Gadgets It Has Decided To Streamline Some Of Its Operations So That It Will Be Able To Be More Course Hero

Irs Releases Draft Partnership Form To Provide Greater Clarity Taxing Subjects

Calameo Irs Instructions For Form 1041 And Schedules A B G J And K 1 19

Irs Federal Tax Form 1040 Types Schedules Instructions

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Calculation Of Gain Or Loss Section 1231 Gains An Chegg Com

Does The Irs Allow A P O Box Address Amy Northard Cpa The Accountant For Creatives

Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Free Download

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Irs Form 4797 Fill Out Printable Pdf Forms Online

Section 1231 And Depreciation Recapture Use This I Chegg Com

What Is Irs Form 1065 How To File It Out Step By Step Guide

Solved How Do I Obtain 121 Exclusion On Portion Of Duplex

Irs Now Adjusting Tax Returns For 10 0 Unemployment Tax Break Forbes Advisor

How To Report The Sale Of A U S Rental Property Madan Ca

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Irs 11 Schedule D 21 Fill Out Tax Template Online Us Legal Forms

Irs Form 4797 Instructions Fill Online Printable Fillable Blank Pdffiller

Form 4797 Sales Of Business Property

Simpletax Form 4797 Youtube

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Free Download

Resources Raymond James

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Federal Tax Forms And Instructions Nina S Soap

A 21 Overview Of Irs Form 1041 Schedules

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

Irs Form 4797 Fill Out Printable Pdf Forms Online

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Chapter 1 Form 4797 University Of Illinois Tax School

Form 4797 How And When To Fill It Out Depreciation Guru

Irs Gives Some Additional Information On Excess Business Loss And Nol Rules Current Federal Tax Developments

Form 4797 Sales Of Business Property 14 Free Download

1231 1245 1250

Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

Completing Form 1040 With A Us Expat 1040 Example

Schedule D Tax Form 1040 Instructions Capital Gains Losses

Irs Form 4797 Guide For How To Fill In Irs Form 4797

What You Need To Know About Form 4797 Millionacres

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Schedule D

0 件のコメント:

コメントを投稿